- 1. What to do if I forget the password? What if the password is not sent to me?

- 2. What is the operational ground of NEO Finance?

- 3. Who can invest with "NEO Finance"?

- 4. How to invest with NEO Finance?

- 5. How much can be invested?

- 6. What fees are applicable in order to invest?

- 7. How does the automatic investment work?

- 8. What is Provision fund?

- 9. What happens if the loan is not repaid?

- 10. What risk is assumed by the investor?

- 11. Can the registration be terminated?

- 12. How are conflicts of interest avoided?

- 13. What is the procedure for calculation of the repaid payments?

- 14. When is the money received from the monthly installment transferred to my account?

- 15. What taxes have to be paid by the investors to the State Tax Inspectorate?

- 16. What is a VIP investor and when do you become one?

- 17. How is recovery performed if the debtor dies?

- 18. What costs will I incur in the case of debt recovery (without the provision fund)?

- 19. What is the selling procedure and price of the payments that are not repaid, when the loan agreement is terminated?

- 20. What will happen if the money in the provision fund runs out? Who will cover the payments?

- 21. What will happen if the company goes bankrupt? What will happen to the debts?

- 22. What is secondary market?

- 23. What taxes are applicable when buying and / or selling investments in the secondary market?

- 23. How to sell an investment in the secondary market?

- 24. How to buy an investment in the secondary market?

- 25. What is XIRR?

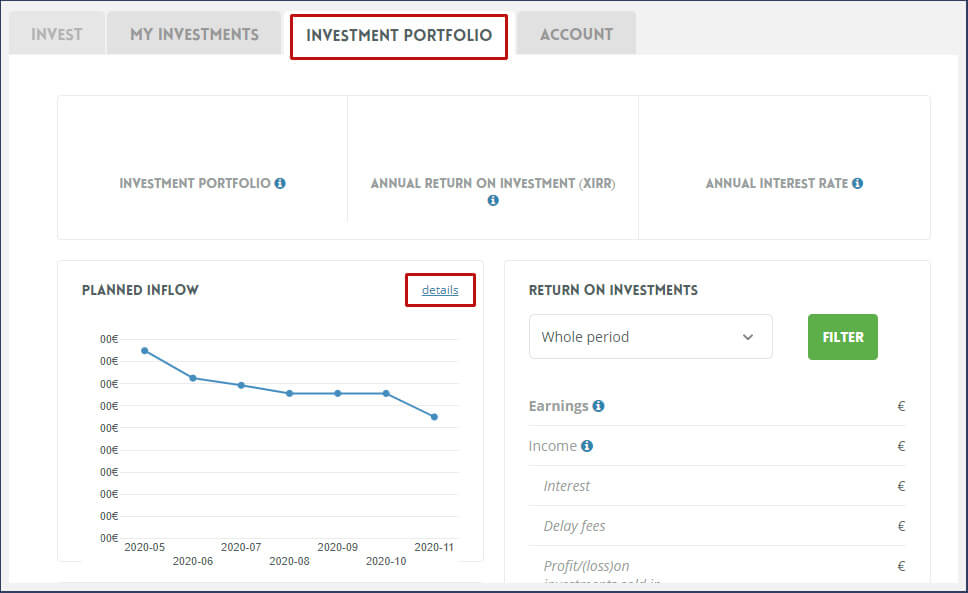

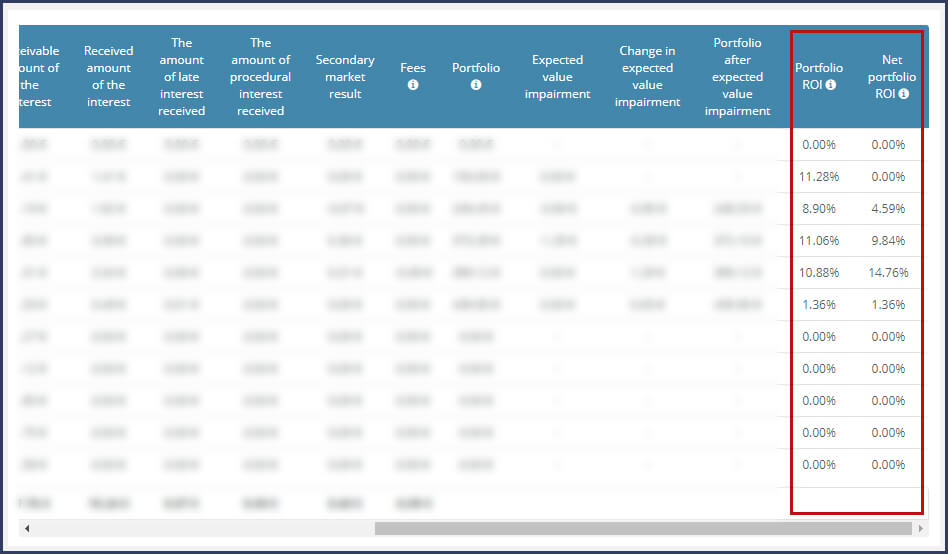

- 26. What is ROI?

- 27. Prevention of money laundering and terrorist financing

- 28. How to use the updated investment data overview window?

- 29. What happens to an investor's account and money in the case of death?

- 30. Why am I being asked to update my personal data?

1. What to do if I forget the password? What if the password is not sent to me?

If you have forgotten your password, use the password reminder function below the password entry field ("Forgotten your password"): select whether you want to receive the reminder via SMS or e-mail. Then press on the link provided to create new password. New password must meet the following conditions:

- The password must be at least 12 characters long;

- The password mus contain uppercase and lowercase letters, numbers, special characters (such as /.,:\“ ).

- The password must be unique and never been used before.

If the login fails, please call +370 687 00300 or write an e-mail to [email protected] and we will help you.

2. What is the operational ground of NEO Finance?

Activity of NEO Finance is supervised by the Bank of Lithuania. In January 2017, the company has replaced its limited electronic money institution licence with the unlimited electronic money institution licence allowing operations in entire European Union. NEO Finance is the only P2P lending platform in Lithuania that holds the licence for unlimited activity, and also is included in three public lists of the Bank of Lithuania: List of Peer-to-Peer Lending Platform Operators, List of Consumer Credit Lenders, and List of Currency Exchange Operators.

List of the Bank of Lithuania: www.lb.lt/en/sfi-financial-market-participants/uab-neo-finance

3. Who can invest with "NEO Finance"?

Citizens of the European Union with a valid personal document (passport or ID card) or valid mobile signature can invest.

4. How to invest with NEO Finance?

- Please register in the account provided for the investors

- Perform the identity verification process in the system

- Open a NEO Finance electronic money account

- Deposit money into it

- You can select one of two investment methods:

- From the list of the borrower applications, select the loans into which you want to invest. In the list, you will find the specified information regarding the loan recipient: income, obligations, credit worthiness rating, position held at the workplace, previous debts, etc.

- Create an automatic investment offer - set the maximum investment amount into the single loan, maturity, specify the credit worthiness ratings of the loan recipients for whom you intend to lend and the size of the interest. The system of "NEO Finance" will automatically provide the best investment possibilities for you.

5. How much can be invested?

• From 20 euros to A, B, C and C- rating loan and from 50 euros to A+ rating loan;

• The limit for the maximum investment in one loan recipient for 12 months is 500 euros. Our system will automatically ensure that this limit will not be exceeded;

6. What fees are applicable in order to invest?

In the primary market, taxes are only applies to short-term (100-300 EUR/ 1-3 months) loans. A 1% brokerage fee is applied to each received installment.

In the secondary market, both selling and buying investments are subject to a 1% brokerage fee, which is calculated based on the sale/purchase price of the investment. You can find more information on taxation for non-lithuanian citizens: www.neofinance.com/en/page/13/non-residents-of-lithuania

7. How does the automatic investment work?

The automatic investment function allows the investor to preselect the criteria of the loans into which they wish to invest, and according to these criteria "NEO FInance" automatically concludes loan agreements on behalf of the investor when the suitable offers appear. This way the investor does not need to constantly follow and review the applications that are being submitted in the system. Furthermore, after the new loan offer appears, all investments are made into it according to the automatic offers of the investors, and manual investments are made only into the remaining amount of the loan (sometimes there is nothing left).

How it works:

The investor selects the automatic investment and specifies the criteria of the loans that are targeted for the investment: credit worthiness rating (one or several) of the loan recipient, minimum interest, loan maturity (exact or from - to), the maximum amount that is invested into one loan and the provision fund can be selected. During the creation of the announcement the funds in your account are not reserved. The announcement criteria will be automatically checked in the system and if there are funds in the accounts, they will be invested under the specified criteria.

When "NEO Finance" identifies the loan application that meets the criteria specified by the investor, it automatically concludes the loan agreement on behalf of the investor. Then a part of the reserved funds is transferred to the loan recipient under the signed agreement (remuneration for the surety is also transferred from the reserved funds if the Provision fund is selected).

8. What is Provision fund?

The provision fund service will no longer apply to investments made from 1 March 2022. The terms and conditions of the service apply only to investments made with the provision fund Service before 1 March 2022.

"NEO Finance" offers the paid service of the Provision fund, reducing the risk of investment further. After deciding to invest with the Provision fund, you will sign the surety agreement with "NEO Finance". Under it, "NEO Finance" itself undertakes to provide the surety for the loan recipient. That means that if the loan recipient is late, even for one day, "NEO Finance" covers the payments directly to the investor and itself recovers them from the Loan recipient later. "NEO Finance" accumulates money in a separate account and covers the payments to the investors from this. The constantly-updated view of the account is published in the investment section of www.neofinance.com. After selecting the Provision fund service, a respective fee is applicable to the investor. The fee depends on the credit worthiness rating of the credit recipient and the loan maturity: 0.23% - 27.54% of the investment sum. All fees are accumulated in the fund, and in the case of delay, payments are covered from the funds accumulated in the Provision fund. If the loan recipient repays the loan in advance or the loan agreement with them is terminated, the fee for Provision fund is reduced in a way that the investor does not incur loss (the investor will always regain the amount they have invested).

9. What happens if the loan is not repaid?

If a loan recipient is late in paying even single payment, they are informed of this via email and text (SMS) message. After 30 days of delay, the debt of the loan recipient is registered with "Creditinfo Lietuva" PJSC and after 40 days of delay the loan recovery is transferred to the debt recovery company. Possible options for the recovery if the loan is overdue:

- If you utilize the Provision fund, "NEO Finance" pays the payments to you as of the first day of the delay. As of the 60th-130th day of the overdue loan, the consumer credit agreement with the recipient of the consumer credit is terminated and the whole amount of the loan as well as interest that is accumulated to that day is repaid to you;

- If you did not use the Provision fund, as of the 60th-130th day of the overdue loan "NEO Finance" terminates the consumer credit agreement with the recipient of the consumer credit, and after its termination offers to buy the debt from you at the market price. If you reject the offer, then the recovery of the debt is transferred to the debt recovery company, court or bailiffs. Statistically the debt recovery can last approximately 2 years, but all payments that are received are transferred to you on the same day by "NEO FInance".

- If the consumer credit recipient dies before the conditions for termination of the consumer credit agreement appear, the consumer credit agreement with the recipient of the consumer credit is not terminated. When the heir arises, a creditor's claim is sent to him informing about the obligation. If the heir refuses to fulfill the obligation, then the recovery of the debt is transferred to the debt recovery company, court or bailiffs. If you have used the Provision fund, "NEO Finance" will continue to pay payments to you as of the first day of the delay until the heirs of the deceased repay the loan in full.

The investor does not need to worry about the recovery of the loan themselves. "NEO Finance" transfers the whole pre-trial and judicial debt recovery to the debt recovery company, and the funds that are received for the debt are transferred to the investor on the same day. All the expenses of the recovery are covered by the debtor.

10. What risk is assumed by the investor?

During the evaluation of the credit worthiness rating of the credit recipients, "NEO Finance" has very high requirements. However, there is a possibility that the recipient of the consumer credit does not uphold their obligations and as a result, the losses are incurred by the loan provider. In order for you to make the decision to invest in the consumer credit responsibly, we provide information about the risks of such type of investments. The loan provider should understand that he assumes all risks of the credit recipient's insolvency, meaning that the credit recipient may fail to fulfil the credit agreement which may result in financial losses for the loan recipient, i.e. failure to receive all or part of the interest that had to be paid by the consumer credit recipient under the consumer credit agreement. The provider may also not receive the full or part of the amount of the consumer credit. The loan provider should understand that, under the current legislation, the recipient of the consumer credit can return the whole consumer credit or a part thereof in advance and, as a result, the loan provider will receive less interest under the agreement than was anticipated. NEO Finance implemented creditworthiness valuation method is based on artificial intelligence (AI) and machine learning technology. A credit rating indicates what is the probability that the person who took the loan for one or other circumstances could delay repay the loan or the loan will not be repaid at all. After deciding to invest in the consumer credits, the loan provider selects the credit worthiness rating(s) of the consumer credit recipients to whom the loans will be provided. "NEO Finance" undertakes to conclude the consumer credit agreements only with the recipients of the consumer credit, who on the day of the credit worthiness assessment day have assigned the credit worthiness rating that is specified in the special conditions. The credit worthiness rating is the expression of the consumer credit recipient's assessment result, it is graded from A+ the highest level of reliability, to E - the lowest level of reliability. "NEO Finance" tries to reduce the risk of insolvency as much as possible, therefore, consumer credits are granted only to the persons with the A+, A, B or C, C- credit worthiness rating, but the loan provider must understand that risk of insolvency remains even for the consumer credit recipients with the high credit worthiness rating. The responsibility of "NEO Finance" regarding the insolvency of the consumer credit recipient is limited. "NEO Finance" is only responsible for the insolvency of the consumer credit recipient if it violated the provisions of the consumer credit recipient credit worthiness assessment and as a result has evaluated the credit worthiness of the consumer credit recipient improperly. In such case "NEO Finance" compensates the losses that are directly incurred by the loan provider.

11. Can the registration be terminated?

To be able to unregister from the www.paskoluklubas.lt/en or www.neofinance.com system, you must have no active investments in the consumer credits.

Contact us by phone +370 687 003 00 or via email [email protected] and inform us of your request. If you have an active electronic money account, we must sign the agreement on the closing of the account, and then we will unregister you from the system.

12. How are conflicts of interest avoided?

To avoid conflicts of interest, neither employees of "NEO Finance", or parties related to them or to a private company, may have better conditions to invest in consumer credits than unrelated persons.

13. What is the procedure for calculation of the repaid payments?

When the loan recipient makes the payment, it is proportionally distributed to the Loan providers according to the share of the amount they invested in the amount of the loan. The amount returned to the loan providers is rounded off to the nearest cent. The excess of the cent parts is not annulled, but is accumulated, until the addition of such amounts reaches at least one cent that will be added to the next repayable payment.

14. When is the money received from the monthly installment transferred to my account?

After consumer credit receiver makes a payment equal to the monthly instalment, investors get their portion of the money no later than the following working day.

As stated in the Law on Consumer Credit, credit receiver has the right to fulfill their commitments outlined in their consumer credit agreement fully or in part. After doing so, they are allowed to request for credit price reduction. Taking this into consideration, if the consumer credit receiver makes a larger-than-required monthly instalment, they are allowed to request for interest recalculation within the upcoming 72 hours. If during the mentioned 72 hours the consumer credit receiver makes a request for interest recalculation, then, right after the interest is recalculated, depending on the amount of money invested, the investors get the adequate portion of the consumer credit and interest. In case the consumer credit receiver does not request for interest recalculation, then, after the 72-hour period is over, depending on the amount of money invested, the investors get the adequate portion of the consumer credit and full amount of interest, including future interest.

15. What taxes have to be paid by the investors to the State Tax Inspectorate?

Since the investors, who invest in loans by using the "NEO Finance" platform are not considered as self-employed, they must only pay the Personal Income Tax for the interest they ACTUALLY RECEIVED, calculated for the financing of loans, i.e. the income is recognised as received during the moment of their actual receipt, and not on the date specified in the payment schedule. Personal Income Tax rate is 15 percent, and is applied to the whole amount of the interest that was actually received during the period. Taxes are deducted from the interest amount received.

Payments of the Personal Income Tax.

Personal Income Tax for the interest paid to non-Lithuanian residents must be deducted and paid into the budget of the Republic of Lithuania by “NEO Finance”. The rate of Personal Income Tax is 15 percent, therefore, prior to paying the interest to the investors, “NEO Finance” will deduct 15 percent of this amount and will transfer the deduction into the budget. If Lithuania has signed the double taxation avoidance agreement with a certain country and the investor has submitted the request regarding the rate specified in the aforementioned agreement to “NEO Finance”, then “NEO Finance” will deduct the respective rate. Lithuania has signed the double taxation avoidance agreements with the following countries: https://www.vmi.lt/cms/en/tarptautines-dvigubo-apmokestinimo-isvengimo-sutartys. Income Tax rate of 0 percent is set with Latvia and Cyprus, and income tax rate of 10 percent is set with other countries.

We would like to note that the Income Tax payable in the investor's state of residence can be reduced by the amount of income tax that was paid in Lithuania. If 15 percent was deducted, and, according to the double taxation avoidance agreement signed between Lithuania and the other country, the tax rate is set at 10 percent, then the investor can reduce the income tax in their place of residence by 10 percent. In the event that “NEO Finance” receives the request regarding the application of the lower income tax rate, the investor can reduce the income tax in their country of residence by the amount that was paid as an income tax in Lithuania.

We would like to note that when choosing the peer to peer lending platform, it is very important to make sure that the tax legislation of that country is adhered to. Otherwise, the investors risk facing violations of the tax obligations, those could involve the investors themselves. “NEO Finance” advises investors to check thoroughly that the peer to peer lending platform does not violate the tax legislation of the resident country prior to investing, due to which they themselves could face the improper payment of the taxes.

16. What is a VIP investor and when do you become one?

The status of VIP investor

Loan provider is awarded with a certain type of VIP investor status if his/her "NEO Finance" active investment portfolio contains following values:

VIP Bronze. Active investment portfolio contains more than € 5,000;

VIP Silver. Active investment portfolio contains more than € 15,000;

VIP Gold. Active investment portfolio contains more than € 50,000;

VIP Platinum. Active investment portfolio contains more than € 125,000.

VIP investor status provides an opportunity for VIP investors to sell the delinquent loans with the coefficient that is 5% higher than for the other loan providers, who do not have the status of the VIP investor. As well, additional accounts are free of charge for VIP accounts according to the following procedure:

VIP Silver members – 1 free additional account;

VIP Gold members – 2 free additional accounts;

VIP Platinum members – 3 free additional accounts.

17. How is recovery performed if the debtor dies?

If the debtor dies there are a couple of debt recovery scenarios.

When "NEO Finance" receives information that the debtor has died, firstly, it ascertains if there are heirs (i.e. if any person accepted the inheritance). If the inheritance is accepted, further recovery is performed from the assets of the heir. Should the heir accept the inheritance under the inventory comprised by the bailiff, the recovery would be performed within the scope of the inherited assets. If the debtor had property, but did not have an heir, then the inheritance is accepted by the state, and the debt recovery is aimed at it (article 5.62 of the Civil Code of the Republic of Lithuania).

If the debtor has died without any property and the inheritance is not accepted, the debt recovery is ceased, because the recovery cannot be aimed at anything. In such case the incurred losses are assumed by the investors.

18. What costs will I incur in the case of debt recovery (without the provision fund)?

No additional fees are charged to the investor. In such case the only costs are time, while waiting for the debt to be recovered.

19. What is the selling procedure and price of the payments that are not repaid, when the loan agreement is terminated?

5 calendar days prior to the planned termination of the credit agreement, "NEO Finance" sends the notification to each of the Loan providers, who invested in this loan, regarding the possibility to sell the overdue loan. If the Loan recipient does not cover all arrears up to the date provided, "NEO Finance" terminates the credit agreement with them and offers to pay the payout to the Loan providers within seven calendar days.

When calculating the price of the payout, the share of the investment that is not returned to the Loan recipient is multiplied by the coefficient that depends on the credit worthiness rating of the Loan recipient and on the offer expiration date, when the Loan provider decides to sell the loan that is overdue. Coefficients depend on the credit worthiness rating of the loan recipient: credit worthiness rating A+: 1,0, credit worthiness rating A: 0.7, credit worthiness rating B: 0.6, credit worthiness rating C: 0.5. Depending on the offer expiration date, each day as of the fourth calendar day 0.05 are subtracted from coefficients of the aforementioned credit worthiness rating (i.e. for the first free days the coefficient of the credit worthiness rating A will be 0.7, on the fourth day - 0.65, etc.). NEO Finance have the right to unilaterally change the above-mentioned coefficients in the following cases: i) When the investment contract is concluded on or before 2022-12-14, not less than 6 months before the entry into force of the updated rates, the future coefficient values and the effective date are published in this pricing; ii) When the investment contract is concluded on or after 2022-12-15, not less than 14 calendar days before the entry into force of the updated rates, the future coefficient values and the effective date are published in this pricing.

From 14.09.2023 or 01.03.2024 (depending on the date of signing of the contract), the coefficient of A, B, C loans is changed: for A+ rating: 1,0 (From 10.04.12. 2021 for new A+ rated loans funded) the coefficient remains unchanged, for A, B, C ratings the weighting is 0,5, C- is not available for sale. Depending on the validity of the offer, from the fourth calendar day to the eighth calendar day, 0,05 shall be deducted daily from the above rating weights.

We also want to draw your attention to the fact that loan providers who have the status of a VIP investor have the possibility to sell overdue loans with the coefficient that is 0.05 point higher than other loan providers, who do not have the status of the VIP investor.

20. What will happen if the money in the provision fund runs out? Who will cover the payments?

The provision fund is formed from the accumulated monetary funds that are obtained from the investors who chose the provision fund. Therefore, the size of the provision fund depends on the total amount of loans covered by the provision fund. NEO Finance would cover the arrears from any other of its accounts, only if the money in the account of the Provision fund ran out.

The Provision Fund service will no longer apply to investments made from 1 March 2022. The terms and conditions of the service apply only to investments made with the Provision Fund service before 1 March 2022.

21. What will happen if the company goes bankrupt? What will happen to the debts?

If bankruptcy is initiated, the appointed bankruptcy administrator will return all funds held in the electronic money accounts to their owners by transferring them into the (client) bank accounts. All funds covering the electronic money of the clients are held in the banks in separate accounts and are not considered as the property of the company. In accordance with the current legislation, the recovery related to the debts of the company cannot be aimed at these funds, they cannot be seized, etc., therefore the company can buy out all electronic money of the clients at any time despite the amount thereof (i.e. it is not limited by the 100 000 EUR deposit insurance amount).

When discussing the obligations of the company, as the operator of the mutual lending platform, in case of the company bankruptcy, we will follow the activity continuity plan that is coordinated together with the Bank of Lithuania, and provides for the specific actions and procedures that have to be carried out. The most important principle – all agreements that are concluded via the system are valid and must be executed further. The information of investors and loan recipients are revealed to one another no later than within four business days so that the agreements can be carried out. This means that the loan recipient will have to pay the monthly payments directly to the investors.

22. What is secondary market?

Secondary market – the possibility for investors to buy and sell investments in consumer credits. Only investments owned by the investor under the ownership rights can be sold in the secondary market, i.e. the consumer credit, in which the investor had invested, is already financed and the consumer credit funds are already paid out to the recipient of the consumer credit. If the investment is sold for less than it was bought for, it is deemed that the loan is being sold with a discount. If it is sold for more, it is considered that the investment is being sold with a premium.

23. What taxes are applicable when buying and / or selling investments in the secondary market?

When buying and selling investments in the secondary market, brokerage fee of 1% is applied. It is calculated with respect to the investment sale price.

23. How to sell an investment in the secondary market?

You can sell the investment in the "my investments" section. After clicking "Sell the investments" you can tick the investments that you want to sell. After selecting the loans that you wish to sell click "continue". In the window that appears you can enter a premium or discount for each loan and see the outcome of the investment should the transaction be performed. You can cancel the announcement at any time, while the investment for sale is not bought by other investors. The investment sale announcement uploaded in the secondary market is valid for 30 days. If this investment is not sold within 30 days, the announcement will be automatically cancelled and in order to further offer this investment to other investors, this announcement must be re-uploaded. If "NEO Finance" initiates the termination of the consumer credit agreement on the grounds of the improper performance of obligations by the debtor, the investment sale announcement is automatically cancelled.

24. How to buy an investment in the secondary market?

The secondary market can be found in the "Invest" section. You can see all the information related to the investment that is being sold, i.e. the investment date, the credit worthiness rating, the remaining share of the loan that has to be repaid, the annual interest rate, the loan maturity, remaining receivable amount, premium or discount and the selling price, in the list of the investments that are for sale.

CAUTION! In certain cases, sale price can exceed the remaining receivable sum, so these two amounts should be compared. In order to acquire the investment in the secondary market click the button "Buy" and sign the agreement.

25. What is XIRR?

XIRR is an indicator of profitability. Based on the amounts and dates of investments and return payments, XIRR shows the rate at which your money is growing over the years.

XIRR under 'My Investments'

The XIRR under 'My Investments' is calculated in two ways, i.e. depending on whether the investment is terminated or not.

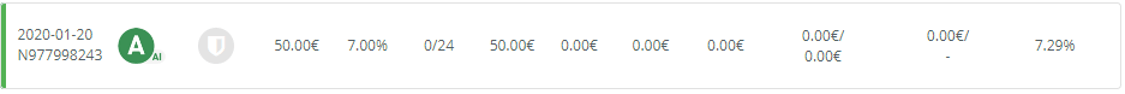

Not Terminated Investment XIRR

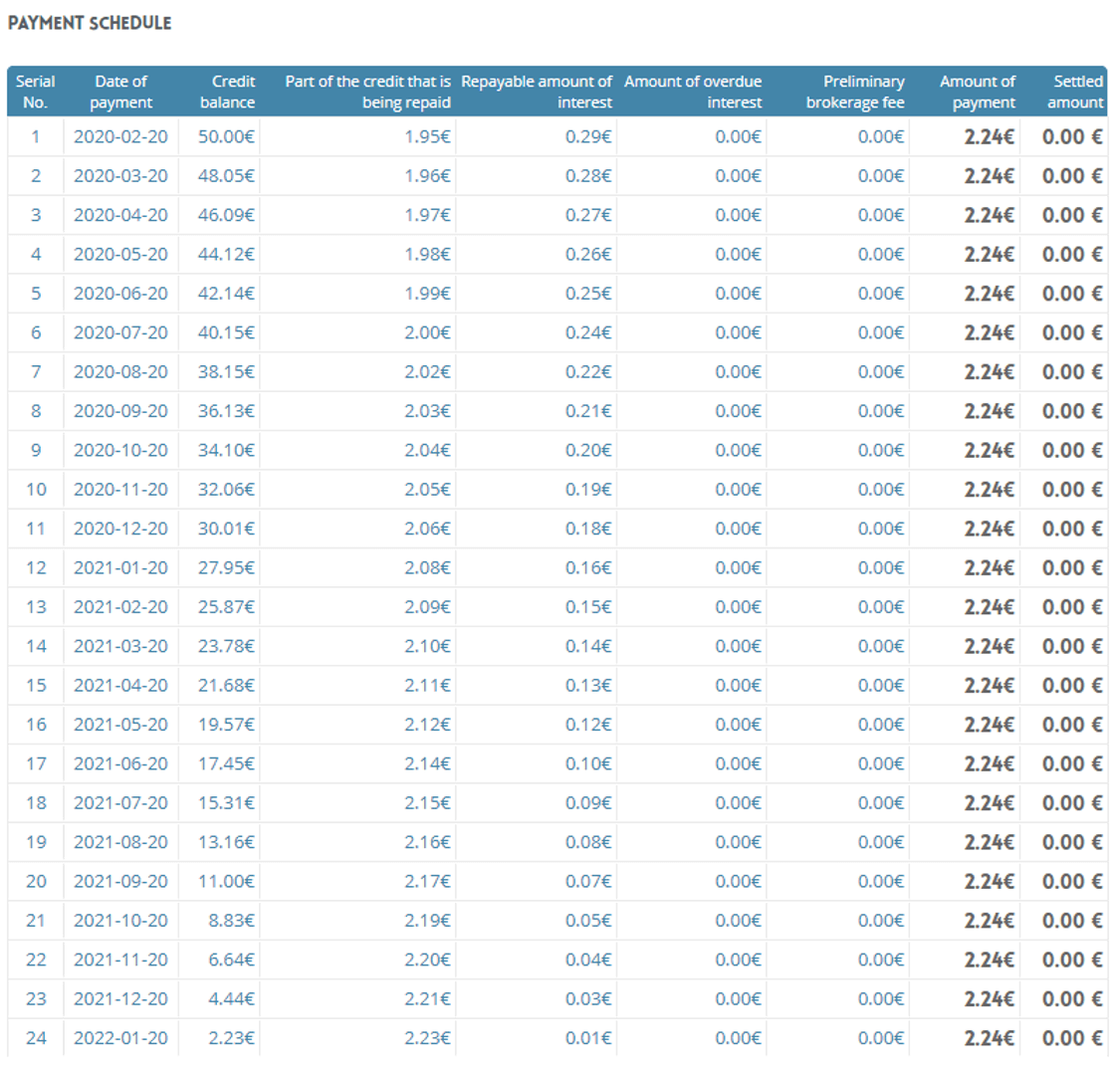

The XIRR for an investment with a current loan agreement with the borrower is calculated by taking the actual cash flows to date and the scheduled future cash flows.

In this case, the actual cash flow is only the amount of the investment, i.e. -50 EUR. Since the investment is current, it is assumed that the borrower will pay on schedule, i.e. you will receive a monthly repayment of EUR 2.24.

Based on cash flows and dates, we get an XIRR of this investment at 7.29%.

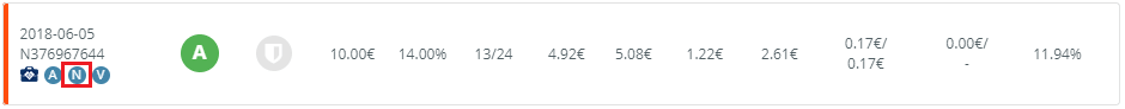

Terminated Investment XIRR

A terminated investment is marked with the letter 'N'.

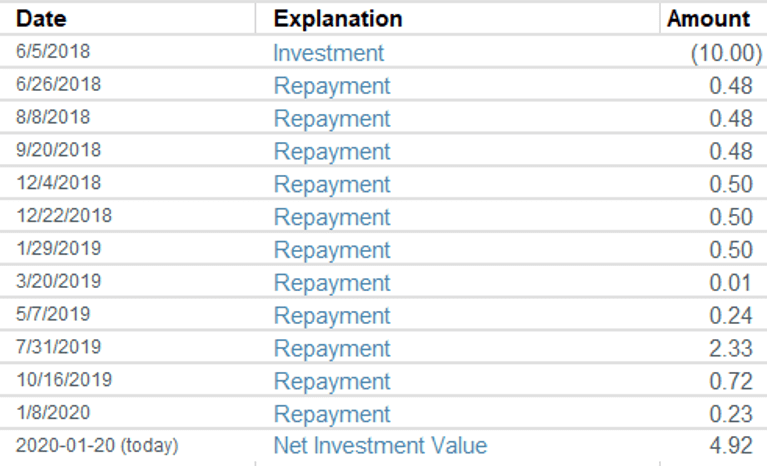

The XIRR of a terminated investment is calculated in the same way as a current investment up to the current day, meaning actual cash flows are taken into account. However, from the current date, the net future payments of the investment are not taken as there is no reason to believe that a borrower will pay according to payment schedule. Instead, The Net Investment Value is calculated using the Investment Value Ratio based on the time since the last received payment, which you can find here: www.paskoluklubas.lt/investor/investment/my/investments/payments/statistics.

In the example below, the loan installment was received less than 30 days ago and the remaining credit payment is EUR 4.92. Multiplying 4.92 EUR by 100% we get the same 4.92 EUR. Below are the cash flows used in the XIRR calculation:

Based on the actual cash flow and net worth of the investment, we get an XIRR of this investment of 11.94%.

XIRR of Repaid and Sold Investments

The XIRR of Repaid and Sold investments is definite and constant indicator of return, since all cash flows have already occurred in the past.

XIRR in the Portfolio Review

The XIRR Portfolio Review is calculated in a similar manner to the XIRR calculation method for terminated investments described in Section 2.2. All actual cash flows up to the current date are taken into account, and on the current day it is assumed that the entire portfolio is realized at the net portfolio value that any investor can find here: www.paskoluklubas.lt/investor/investment/my/investments/payments/statistics.

26. What is ROI?

The goal of all investments is to make the risk pay off. Remuneration is measured by return on investment (ROI) as standard.

ROI is calculated as the total return divided by the initial capital held at the beginning of the valuation period.

What is the Net Portfolio ROI?

Return on investment ratio, taking into account the expected decrease or increase in value.

Where to find ROI?

You can find the ROI metrics for your portfolio on the INVESTMENT PORTFOLIO tab by clicking "details" next to the "Planned Inflow" graph.

You'll be taken to the "Scheduled and received installments" page, where you'll see a variety of details. You will find ROI metrics at the end of the table below the graph.

ROI in the 'Scheduled and received installments' section

Each month’s investment result, ROI, is represented in annual terms.

The ROI of the portfolio is calculated according to the formula:

Portfolio ROI = (Interest received (including default and procedural interest) + Secondary market result + Fees) / Portfolio * 12

The Net Portfolio ROI is calculated according to the formula:

Net portfolio ROI = (Amount of interest received (including default and procedural interest) + Secondary market result + Taxes + Monthly change in expected impairment) / Net portfolio * 12

Putting ROI data into practice

With the help of ROI you can effectively measure your return result and compare it with the previous months:

* While changing the investment method - strategy;

* While monitoring the changing global economic situation.

The ROI is usually lower in the first months of investment due to the debt collection process, the results of which are visible after a year or two.

Because the ROI indicator only shows the past, it has no effect on future results.

Negative ROI when investing with the Provision Fund

When investing with the Provision Fund service, the ROI is usually negative in the first months. This is perfectly normal due to the tax that is paid for the entire future period at the beginning of the investment.

This does not mean that your investment is unprofitable. A negative ROI at the beginning of the investment is offset by an ROI at the end of the investment period.

Therefore, the total investment result of investing with the protection of the Guarantee Fund should be assessed in the sum of all months of the investment period.

27. Prevention of money laundering and terrorist financing

“NEO Finance“, AB (hereinafter – “Company”) is a company which has an electronic money institution license (more: https://www.lb.lt/en/sfi-financial-market-participants/neo-finance-ab). Taking into account the Law on Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania, the Company must apply all possible and effective measures for anti-money laundering control and prevention of terrorist financing.

1. What is money laundering, terrorist financing and its prevention?

According to the Law on the Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania, money laundering is:

• altering the legal status of property or transferring property, knowing that the property is derived from or participating in a criminal offense, in order to conceal or disguise the illegal origin of the property or to help any person involved in the crime to avoid the legal consequences of that offense;

• concealment or disguise of the true nature, true origin, source, location, disposition, movement, ownership or other rights with respect to property, knowing that such property is the proceeds of crime or participation in such activity;

• acquisition, management or use of property, knowing at the time of acquisition (transfer) that the property was derived from criminal activity or through participation in such activity;

• preparation for, attempt to commit, complicity in any of the acts listed in points 1, 2 and 3.

Terrorist financing is an act that is a criminal offense under the 1999 December 9 Article 2 of the International Convention for the Suppression of the Financing of Terrorism.

Prevention of money laundering and terrorist financing - implementation of appropriate measures to prevent money laundering and terrorist financing.

2. What is the “Know Your Customer” principle and why do I need to provide information to the Company?

The Law on Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania, as well as other legal acts oblige specific entities to establish the identity of the customer and beneficiary and provide for the obligation to implement the “Know Your Customer” principle towards their new and existing customers, whereas the entities required by this Act must:

• know what activities the client is engaged in (what is the nature of his business), analyze his activities;

• know who the beneficiaries of the client are, i. y. natural persons in whose interests or for the benefit of which transactions or activities are carried out (the beneficiary of a legal person is determined up to the natural person (s), regardless of the number of controlling legal persons);

• conduct ongoing monitoring of the client's business relationships, including examination of transactions entered into during such relationships, to ensure that the transactions correspond to the Company's knowledge of the client, its business (type and nature of transactions, nature of transactions, business partners, territory and etc.) and the nature of the risk;

• understand the source (origin) of the client's funds.

The Company may obtain and verify this data upon receipt of answers from customers, explanations to the questions provided by the Company (for example, by filling in the customer and beneficiary identification form), documents, evidence and other relevant information.

The Company must also ensure that the money laundering and terrorist financing risk assessment is based on up-to-date and accurate information, and therefore must regularly review and update the documents and other information provided during the identification of the customer and the beneficiary. This provision applies not only to new but also to existing customers of the Company. Therefore, you must notify the Company of any changes in any information as promptly and in detail as possible. It should be noted that filling in the customer and beneficiary identification forms is also mandatory when updating the information about the customer, so after a while you will have to update the information provided to the Company.

The Company ensures that the information provided by the customer, data related to their business relationship, is protected like any other confidential information.

3. What are the possible legal consequences if the client does not provide, avoids or refuses to provide the information requested by the Company or the information provided by the client is insufficient, incomplete and the client does not correct the information within the deadline set by the Company?

We kindly ask you to cooperate with the Company and provide information in a proper and timely manner. We would like to inform you that in accordance with the provisions of the Law on Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania, the Company may not execute or suspend customer operations or transactions, as doing so would violate the Law on Prevention of Money Laundering and Terrorist Financing and other relevant legal acts. In addition, in such cases, the Company may terminate the business relationship with the client in accordance with the Law of the Republic of Lithuania on Prevention of Money Laundering and Terrorist Financing. In cases when the Company reasonably assumes that suspicious monetary operations or transactions are being performed, the Company must inform the Financial Crime Investigation Service under the Ministry of the Interior of the Republic of Lithuania.

Detailed information on the legal acts regulating the prevention of money laundering and terrorist financing is available on the websites of the Financial Crime Investigation Service under the Ministry of the Interior of the Republic of Lithuania (internet links:www.fntt.lt/en/money-laundering-prevention/activities/226 , www.lb.lt/en/prevention-of-money-laundering-and-terrorist-financing). In addition, all legal acts in force in the Republic of Lithuania are publicly published on other websites.

28. How to use the updated investment data overview window?

From now on, you will find the most relevant investment indicators and data in the updated overview field of the NEO Finance platform.

In one window you will be able to see your investment result in percentage and total terms, invested and reserved funds and your account balance. You will also be able to conveniently track all cash movements in your account in the conveniently located cash flow fields:

• Deposits. Indicates how much money you have transferred to your NEO Finance account during the entire period.

• Withdrawals. Indicates how much money you have withdrawn from your NEO Finance account over the entire period.

• Transaction fees. Indicate how much you have paid for bank transfer payments.

• Invested amounts. Indicates the amount you have invested in loans over the entire period.

• Investment related installments. Indicate the amounts received from investing in loans from borrowers.

• Other operations. All other operations that are not defined in the above fields are indicated.

29. What happens to an investor's account and money in the case of death?

Upon the death of the investor, his investment portfolio and account balance are transferred to the NEO Finance account opened by his/her heir. In this case, the heir must contact the NEO Finance, submit the investor's death certificate and inheritance documents, register on the NEO Finance platform, create an account and complete personal identification procedure. Following these steps, the investment portfolio and account balance of the deceased investor are transferred to the heir's account.

Please note that investments are not divided into several parts. Therefore, if there is more than one heir, additional applications/documents must be provided by the heirs of the deceased investor. All heirs must confirm that they allow to transfer their part of inheritance to one of the heir and that heir had to approve it.

30. Why am I being asked to update my personal data?

NEO Finance AB, in accordance with the Anti-Money Laundering (AML) policy, aims to ensure the accuracy of customer data and therefore has the right to request the renewal of customer identification on the platform upon expiry or after the expiry of the customer's personal data verification on the platform.

Failure to update the customer's personal data will result in the restriction of your access to your account. You will only be able to continue to use all features once you have updated your personal data.

You can update your personal data in any of the following ways:

-

By uploading a copy of your ID.

-

IDENFY device with a video camera.

If you have any questions, do not hesitate to contact us at [email protected] and we will be happy to help.